3 Gold Stocks Percolating Right Now

Time to buy gold stocks as the metal hits multi-month highs?

The yellow metal has been on fire, with gold hitting multi-month highs and threatening to run to new 52-week highs should its recent momentum continue. As such, gold stocks have been on the move as well, pushing higher as its underlying product gains in value.

To no surprise then, the SPDR Gold ETF (NYSEARCA:GLD) continues to climb as well, a trade we outlined the other day as part of our daily Top Stock Trades note. Should it hold up over support, the GLD can certainly press higher and threaten to make a much larger breakout. Let’s look at three of the best gold stocks that could climb as a result.

Gold Mining ETFs

The most direct way to play gold is through physical bullion. Meaning that investors can head to their local coin and metals dealer or an online site that sells gold coins, bars and bullion. That’s the most obvious and direct way of investing in the metal, but there are added costs to account for. Storing the metal, shipping it and paying a premium are all considerations before making a decision.

Then there’s the futures market, which is a direct way to purchase the metal. However, short of playing these contracts as a trade, they will eventually expire. It will force the investor to continually “roll” their investment into another futures contract or exercise the contract and take delivery of physical gold.

So that leaves gold stocks ETFs as one alternative. Investors can consider the GLD ETF, which we highlighted above as one option. Of the gold ETFs, it’s certainly the most popular. While there are drawbacks to owning gold ETFs vs. physical bullion (just as there are drawbacks to owning the latter instead of the former), gold ETFs are certainly the easiest to buy and sell. It’s just like buying and selling a stock and it makes for a simple way to diversify.

Another option? Owning gold miner ETFs. The largest and most well-known are the VanEck Vectors Gold Miners ETF (NYSEARCA:GDX) and the VanEck Vectors Junior Gold Miners ETF (NYSEARCA:GDXJ). Gold miners perform much like gold, but generally have larger moves in the both directions. So if you believe gold is set to rally, it’s quite likely that the GDX and GDXJ will outperform. If you believe gold is set to fall, these two will likely like underperform the underlying metal.

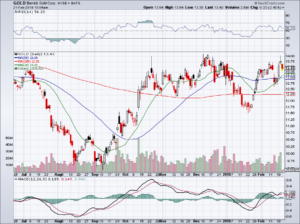

Barrick Gold (GOLD)

Getting into company-specific gold stocks, one consideration is certainly Barrick Gold (NYSE:GOLD). The miner commands a market cap of $24.1 billion after it merged with Randgold at the beginning of the year. Aside from the synergies created by the deal and the benefits of larger scale, GOLD has one big benefit investors miss when investing directly in gold or the GLD: yield.

One big complaint about investing in gold is that it’s a hard asset. It does not generate income, report profits or have a business that becomes more valuable over time. Instead, it simply relies on investor demand and inflation to boost its value. With Barrick though, investors can collect a 2% dividend yield from their investment. That’s no 7% like you get from AT&T (NYSE:T), but it is a nice chunk of income.

Analysts predict that revenue will rise 16% this year, fueling a 29% increase in earnings to 45 cents per share. I don’t like to put much (if any) credence into outlooks two years out because commodity prices can fluctuate so much in that span, but analysts are calling for a further 9% bump in earnings despite relatively flat revenue growth in fiscal 2020.

Kirkland Lake Gold (KL)

A much smaller name worth considering is Kirkland Lake Gold (NYSE:KL). Standing with a market cap of “just” $7 billion, KL is less one-third the size of GOLD. However, that doesn’t mean we should ignore this business.

On Thursday, shares are bursting higher, climbing over 7% and hitting new 52-week highs after management raised its 2019 production outlook. More production amid rising gold prices means more revenue and more profit. Assuming that’s the case, the estimates for fiscal 2019 will likely need to come up.

KL still needs to report its fourth-quarter earnings results for fiscal 2018. Full-year 2018 estimates call for earnings of $1.23 per share on sales of $880.5 million. In Q3, management said it expects a strong finish to the year. If it can top those estimates and provide strong guidance, the stock could have more upside. Specifically, estimates call for earnings of $1.59 in fiscal 2019 on revenue of $1 billion, representing growth of 29% and 13.6%, respectively.

With more than $250 million in cash and no debt, Kirkland is attractive in regards to the balance sheet but it pays a paltry dividend yield of just 0.35%. One other note: KL stock has been ripping, so waiting for a pullback may be wise for investors. Another note? KL will report earnings on February 22nd.

Bret Kenwell is the manager and author of Future Blue Chips and is on Twitter @BretKenwell. As of this writing, Bret Kenwell is long T.

See Also From InvestorPlace:

- 7 Cheap Stocks That Make the Grade

- 7 Healthy Dividend Stocks to Buy for Extra Stability

- 9 High-Growth Stocks to Buy Now for Monster Returns

Category: Commodity Stocks