5 Gold And Silver Stocks Touching Intraday Highs

These gold and silver shares turned higher today as broader market sentiment shifts

U.S. stocks have rocketed higher this week thanks to a sudden dovish tilt from Federal Reserve policy officials as the futures market screams for multiple rate cuts this year.

Suddenly, the U.S. economy is looking uneven as a fiscal drag (President Donald Trump’s tax cuts are fading), a deepening trade rift and weakness overseas taps the brakes on things like manufacturing activity.

And just like that, instead of worrying about increasing regulation on big technology stocks or a disruption to global supply chains into and out of China, Wall Street is enjoying the sugar rush from the promise of another dose of ultra-cheap money from the Fed. They don’t even play coy anymore — they’re just a bunch of liquidity junkies.

The U.S. dollar is weakening in response, as monetary malfeasance raises the risk of runaway inflation and higher commodity prices.

Gold and silver stocks briefly caught a bid today in response, sending the metals up off recent technical support levels. While most of their share prices normalized, all of these stocks exhibit strong technical signals to watch into next week. Related mining stocks have pushed higher as well. Here are five gold stocks and silver stocks ready for new money:

Harmony Gold Mining (HMY)

Shares of Harmony Gold Mining (NYSE:HMY)are rising up and off of support form its 50-week moving average, set for another challenge of its 200-week moving average and a possible end to a four-year downtrend.

The company explores, develops, and processes gold producing properties in South Africa and Papua New Guinea.

Shares were recently upgraded to overweight by analysts at JPMorgan. Back in December, the company and its Wafi-Galpu Joint Venture partner Newcrest Mining Limited signed an agreement with the Independent State of Papua New Guinea to proceed with the development of that new project.

Kinross Gold (KGC)

Shares of Kinross Gold (NYSE:KGC) are challenging their 200-day moving average, rising more than 40% off of their recent low in what looks like a setup for a run at the early 2018 highs near $4.75.

Such a move would be worth a gain of nearly 40% from here. The company produces precious metals in its facilities throughout the United States, the Russian Federation, Brazil, Chile, Ghana and Mauritania.

As of the end of 2018, the company has proven and probable mineral reserves of roughly 25.5 million ounces of gold. The company will next report results on July 31 after the close. Analysts are looking for earnings of two cents per share on revenues of $815.7 million.

When the company last reported on May 7, earnings of seven cents per share beat estimates by five cents despite a 12.4% decline in revenues.

NovaGold Resources (NG)

Shares of NovaGold Resources (NYSEAMERICAN:NG) are rising up and off of solid support going back to 2015, setting the stage for a challenge of the mid-2018 highs near $5, which would be worth a gain of roughly 20% from here. The company is focused on developing its Donlin Gold project.

The company recently reported a loss of two cents per share, matching the estimates of two analysts, while reaffirming their forward guidance. The Donlin Gold project is a large, still undeveloped deposit about 280 miles northwest of Anchorage, Alaska.

The deposit has proven and probable reserves estimates at 33.9 million ounces of gold and a rate of around 2.1 grams per ton.

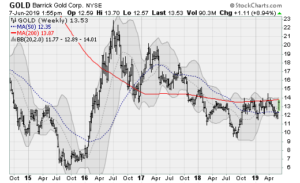

Barrick Gold (GOLD)

Shares of Barrick Gold (NYSE:GOLD) are rising off of a solid base of support near the $12-a-share level to once again attempt a breakout above its 200-week moving average that’s been in play since late 2017.

Earlier this month, management indicated that company leadership had met with government officials in Papua New Guinea to reaffirm their commitment to a mining lease extension set to expire on Aug. 16.

The company will next report results on July 24 before the bell. Analysts are looking for earnings of eight cents per share on revenues of $2.1 billion.

When the company last reported on May 8, earnings of 11 cents per share beat estimates by two cents on a 16.9% rise in revenues.

First Majestic Silver (AG)

Shares of First Majestic (NYSE:AG) are rallying off of multi-year support near the $5-a-share level, ready for a breakout above the 200-week moving average.

The stock has basically gone nowhere since 2016, but looks ready to come out of hibernation. Analysts at B. Riley FBR recently initiated coverage, noting the stock offers significant leverage to silver prices.

The company will next report results on Aug. 13 before the bell. Analysts are looking for a loss of two cents per share on revenues of $134.9 million.

When the company last reported on May 9, earnings of a penny per share beat estimates by four cents on a 48.1% rise in revenues.

As of this writing on June 7, 2019, William Roth did not hold a position in any of the aforementioned securities.

See Also From InvestorPlace:

- 3 Wonderful, But Ignored Vanguard ETFs

- 7 S&P 500 Dividend Stocks to Buy at Least Yielding 3%

- 7 A-Rated Stocks to Buy Under $10

Category: Commodity Stocks