4 Triggers That Could Kick Gold Into High Gear

Here’s why the current gold rally will keep going

“Gold will never produce anything,” Warren Buffett once declared. “Gold has two significant shortcomings, being neither of much use nor procreative.”

And yet, this “lifeless” asset often springs to life at the exact moment when many investors are eulogizing it. In fact, gold usually finds its legs whenever stocks like Berkshire Hathaway (NYSE:BRK.A, NYSE:BRK.B) are rolling over and playing dead.

The last 12 months provide one revealing example. Gold has soared 27%, while Berkshire shares have dropped 3%.

And would you believe it? This “lifeless forever” asset has outperformed the legendary Berkshire Hathaway for the last two decades as well. You see, gold may be an asset that “will never produce anything,” but that doesn’t mean it will never produce a profit for investors.

Gold’s price zigs and zags, just like every other financial asset. But since gold is a nontraditional asset, it defies traditional investment analysis. That forces us investors to impose an analytical process on those moves — and to determine a rationale for them.

Geopolitically, the planet is enjoying relative calm. Sure, a few hot spots are grabbing an occasional headline, but in general, the world’s major powers are as serene as a yoga class.

Still, the gold price is rising. So let’s take a deeper dive into the four factors that tend to trigger major gold rallies.

Gold Trigger: Financial Market Cyclicality

Sometimes gold prices seem to rally for no particular reason — just because. But this type of advance usually launches from some sort of extreme condition in the financial markets. In October 2018, for example, professional money managers had amassed their largest-ever short position in gold futures contracts. In other words, these folks had placed a very big bet against gold.

Ironically, whenever this group of investors leans hard to one side of a trade, it usually pays to take the other side. As a group, I call these investors the “flock money” because they tend to act like sheep, especially at the extremes of a market.

They flock toward the same trade at the same time. Whenever that happens, the trade becomes “crowded” and there are very few investors left to buy into the trade and push its price higher. That’s when a reversal usually takes place. Coincidentally, money managers placed their second-largest-ever bullish bet on gold in August 2011, immediately before the gold price topped out and began a wicked four-year slide.

“Since these guys were wrong at the top of the gold market,” I remarked last October, “might they also be wrong now?”

We now have our answer: Yes.

The gold price has rocketed nearly 26% since October, the moment professional money managers built their largest-ever short position. All financial assets oscillate between extremes — from lows to highs, and back again. Gold is no different. But unlike most other financial assets, gold tends to zig higher when stocks are zagging lower.

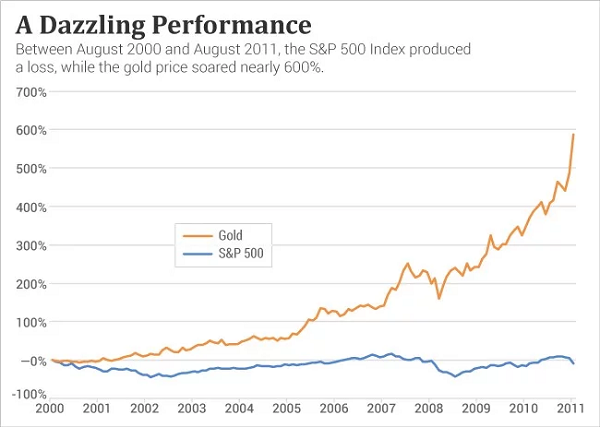

During the 11-year span from August 2000 to August 2011, the S&P 500 slumped more than 25%. But gold soared nearly 600% during that time frame.

Since then, however, gold has taken a backseat to the stock market. It has retreated 22% from its 2011 record, while the S&P 500 has advanced to new all-time highs. Financial markets don’t like extremes and tend to “revert to the mean.” This tendency is the “just because” factor that sometimes causes lowly valued assets to rise in price, or richly valued ones to fall.

The current financial landscape is littered with extremes. The bull market in U.S. stocks is well over 10-years old. And despite recent weakness, the major averages hit new all-time highs as recently as last month. The U.S. dollar is also strong — trading close to the 13-year high it reached in 2017. Ditto, the bond market. The prices of most U.S. Department of Treasury securities are close to their multi-decade highs (that is, yields are close to multi-decade lows).

All of these assets are featuring perfection pricing. To be sure, this pricing could become even more perfect, but that’s the low-probability bet. The high-probability bet is that investors will reduce their exposure to high-flying U.S. assets and increase their exposure to low-flying assets like gold. Just because.

Economic Crisis

The ongoing U.S.-China trade war is taking a bite out of global growth and threatens to consume it completely.

The International Monetary Fund recently warned that trade tensions have “inevitably affected” the Chinese economy. “While a moderate slowdown is expected in 2019, uncertainty around trade tensions remains high and risks are tilted to the downside,” the IMF stated in a recent report.

The IMF also warns that the trade war will have a significant impact on market sentiment and jeopardize the current projections for global growth recovery.

Trade wars, like actual wars, are much easier to start than to stop or contain. We have a president who believes trade wars are easy to win. But the longer this trade skirmish drags on, the greater the risks to economic growth. Moreover, trade wars can mutate into other forms of warfare.

Zhou Xiaochuan, formerly the governor of the People’s Bank of China, just warned that we could see the trade war expand into a larger, wide-ranging conflict between the two countries. Already, he observed, “the trade war is evolving into a financial war and a currency war.”

Conflicts of this sort could lead to an economic crisis of some significance. At that point, geopolitical tensions could flare up as well — and cause widespread economic trauma.

Geopolitical Stress

No major hot wars are raging on this orb of ours, but tensions are on the rise in various locales. Massive pro-democracy protests in Hong Kong have been raging for several weeks and become increasingly violent.

Meanwhile, North Korea’s Kim Jong Un is busy beefing up his military capabilities. He’s been firing so many missiles into the sea that he resembles Kramer from the TV show “Seinfeld” whacking golf balls into the ocean. In the Middle East, the risk of a confrontation with Iran, for example, is a serious possibility. The United States, Saudi Arabia and Israel all regard the Iranian government as a growing threat that must be contained.

U.S. relations with both China and Russia are so strained that both countries are seeking ways to work around America. In the last two weeks, China announced it would halt all purchases of U.S. agricultural products. In 2017, China imported $19.5 billion in agricultural goods from the United States, making it the second-largest buyer. But that number dropped 50% last year, as the trade war escalated. Now China is pushing that number to zero.

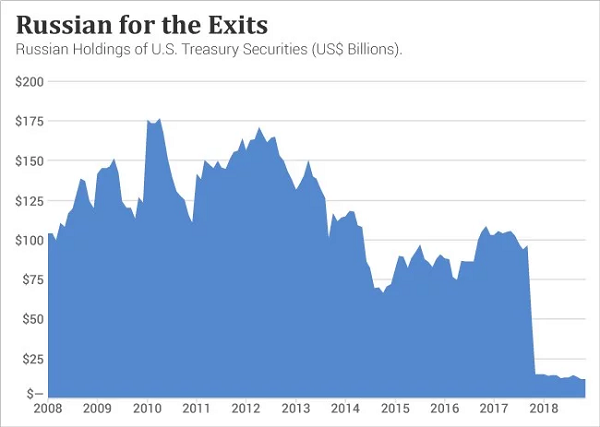

Russia is also devising “work-arounds” from the United States. “De-dollarize” is the term Russian President Vladimir Putin uses to describe his efforts to reduce his country’s dependence on the greenback. It could become a serious threat to the dollar’s reserve currency status.

“Russia is acting on a pledge by President Vladimir Putin to shrink the role of [the] dollar in international trade as tensions sour between Washington and Moscow,” Bloomberg News reports. “The shift is part of a strategy to ‘de-dollarize’ the Russian economy and lower its vulnerability to U.S. sanctions.”

As this chart shows, the Central Bank of Russia dumped most of its U.S. Department of Treasury holdings last year, unloading about half of its dollar reserves. This “de-dollarizing” trend could significantly undermine the greenback’s value, which could trigger a major boost to gold-buying interest worldwide.

Monetary Instability

As we survey the world’s major currencies, we find no hint of a crisis. However, bond yields are abnormal, to say the least. To most folks, they seem simply crazy.

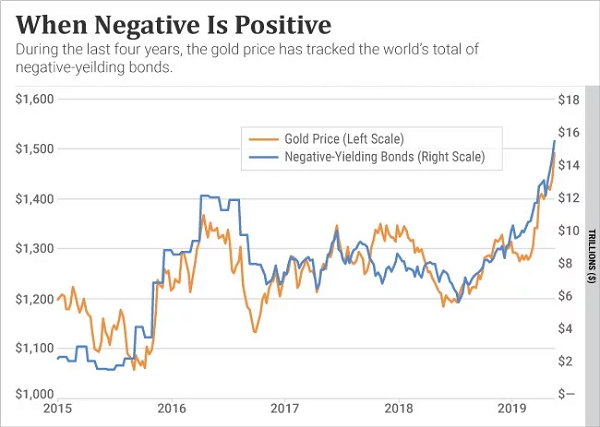

More than one quarter of the world’s bonds are “paying” a negative yield. These “grifter” bonds literally take a little bit of your money away from you every day. Bonds are supposed to pay money to the lender, not take it away. Negative yields have become so pervasive that a whopping $15 trillion worth of bonds are offering them.

Traditionally, the gold market would gain strength whenever fixed-income assets like bonds and certificates of deposits were paying yields that were below the rate of inflation. After all, if bonds can’t match the inflation rate, then gold seems like a better alternative because the gold price tends to offset inflation over time.

But today’s situation is without precedent.

Trillions of dollars’ worth of fixed-income assets are doing more than yielding less than the prevailing inflation rate. They also are yielding a loss — a negative return. This bizarre condition is nudging capital into the gold market. The chart below tells the tale.

Clearly, this phenomenon is affecting the gold market. Therefore, if the tally of negative-yielding bonds continues to expand, growing numbers of investors could seek refuge in the gold market.

This bizarre condition in the bond market likely will morph into a traditional form of monetary instability. In other words, as bond yields move higher, various governments will find themselves under the strain of rising debt-service obligations. And when governments find themselves under stress, their currencies usually pay a price.

If global currencies suffer bouts of weakness, gold would attract safe-haven buying. Of course, some folks might also seek refuge in the U.S. dollar. But the greenback is not immune to crisis. Although it remains the “prettiest horse at the glue factory,” as my friend Doug Casey likes to say, it is still a “horse,” and a heavily indebted one at that.

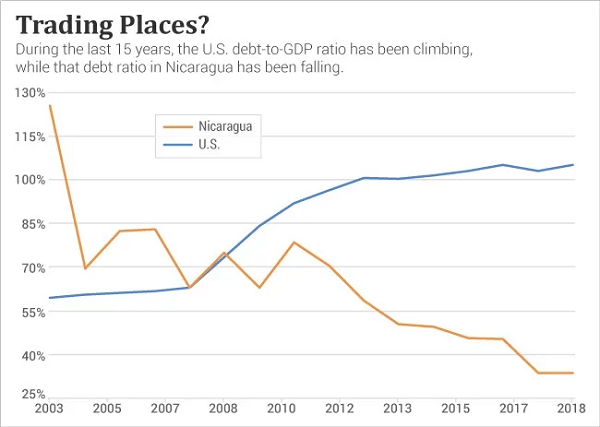

U.S. federal finances are heading in an unhealthy direction. Our towering debt load would make a banana republic blush. The U.S. government’s debt recently topped $22 trillion — a stunningly large sum equal to 105% of gross domestic product.

The chart below presents a shocking contrast between the United States and Nicaragua.

Back in 2003, Nicaragua’s debt-to-GDP ratio was 125% — or more than double the U.S. level. But after several years of solid economic growth, the Nicaraguan balance sheet improved significantly, while ours deteriorated. Today, the U.S. debt-to-GDP ratio is more than triple the Nicaraguan level. Obviously, Nicaragua remains a poor country, while the U.S. remains a rich one. But no nation holds a monopoly on wealth.

Sometimes the first become last, or at least no longer first. Any economic trend that diminishes America’s economic might is a trend that could undermine the strength of its currency and send haven seekers into the gold market.

Gold’s “Room to Grow” Rally

James Grant, my former mentor and editor of Grant’s Interest Rate Observer, refers to gold as an “investment in monetary disorder.” Certainly, that’s been true throughout history. But monetary disorder in the United States has been a relatively rare phenomenon. So here in America, gold is more often a trade than an investment. It is a trade on the unwinding of financial excesses.

And one could argue that the 40-year bull market in bonds, the 10-year bull market in stocks, and the five-year mega-bull market in cryptocurrencies might all qualify as financial excesses. We won’t know for sure until we look back at these bull markets through the lens of history.

But they certainly look like excesses.

Alternatively, a little bit of geopolitical turmoil could add some luster to the gold market. In other words, the nascent gold rally has plenty of room to grow — and run toward new record highs. More importantly, the rally also has plenty of reasons to grow. Negative interest rates, toppy stock markets, rocky geopolitical relationships and volatile currency markets all tend to stimulate the gold-buying impulse.

Eric J. Fry has been a specialist in international equities for nearly two decades. He is known for his extraordinary long-term track record, which includes numerous “10-bagger” calls. And Eric’s track record on the short side is just as remarkable.

See Also From InvestorPlace:

- 7 of Worst ETFs — Boot These From Your Portfolio Right Now

- 7 Tech Industry Dividend Stocks for Growth and Income

- 7 Stocks the Insiders Are Buying on Sale

Category: Gold