High Yield From Renewable Energy

Although the rate of growth has slowed, developing and operating renewable energy facilities remain on a growth trajectory. A more moderate pace will allow the industry to sustain growth over an extended number of years better.

Developers of renewable energy projects finance that development with the use of high-yield business structures as the final owners of the projects. The pass-through renewable energy companies provide the capital for development, and investors receive attractive dividend streams.

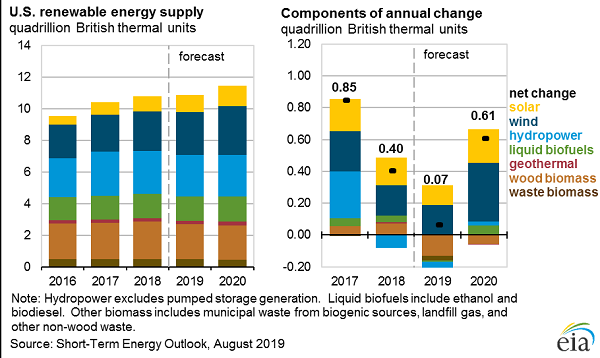

The chart below recently published by the U.S. Energy Information Agency (EIA) shows the agencies short-term forecast for renewable energy supplies through 2019.

You can see that new solar and wind energy sources will continue to develop and go online at a steady pace. Longer-term, there are forecasts for continued growth in renewable energy sources through 2050.

After a renewable energy project is up and running, the generated power is typically sold through long term contracts. This ensures the project will generate a return on the capital invested. There are a handful of public companies that focus on owning renewable energy assets and paying attractive dividends to investors. Here are three to consider.

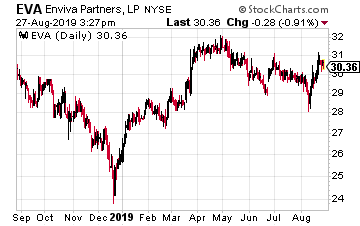

Enviva Partners, L.P. (EVA) is a publicly-traded master limited partnership (MLP) that takes a different type of natural resource, wood fiber, and processes it into a transportable form, wood pellets.

The pellets are sold on long term contracts to companies in the U.K. and Europe where they are burned to produce electricity. Enviva owns six processing plants that can produce three million metric tons of pellets per year. The company also owns the marine terminals used to export pellets.

Enviva has increased its distribution every quarter over the three years since its IPO.

EVA currently yields 8.4%.

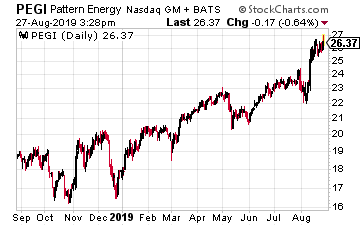

Pattern Energy Group (PEGI) owns and operates wind and solar power generating assets in the U.S., Canada, and Japan. The company currently owns 24 facilities that can generate 2,862 MW of power.

There are seven projects in the development pipeline where PEGI has the right of first offer. A separate company, Pattern Development constructs new projects, puts them on long term power purchase contracts, and then transfers the assets to PEGI.

Pattern Energy Group has an ownership stake in Pattern Development, so it also participates in the capital gains of development.

The current dividend rate has been flat for the last two years, but management expects to resume distribution growth in as cash flow coverage of the dividend continues to improve. PEGI yields 6.5%.

TerraForm Power Inc. (TERP) is an owner and operator of a 3,700+ M.W. renewable power portfolio including solar and wind assets in North America and Western Europe. Revenue is evenly split between wind and solar power.

Infrastructure assets investing expert Brookfield Asset Management is the largest shareholder and sponsor of TeraForm Power.

The company is focused on conservative growth through acquisitions and internal efficiency improvements and forecasts 5% to 8% annual dividend growth.

Current yield is 4.8%.

$25k = $28,762 in annual income for life

With one simple strategy, you’ll be able to take $25k from your 401(k) or IRA and turn it into tens of thousands of dollars in income every single year. You will only find the strategy FREE when you click here.

Category: Energy