It’s Energy Infrastructure Dividend Increase Time With These Three Stocks

When we roll into a new calendar quarter, typically first out the gate with dividend announcements are stocks in the energy infrastructure sector. These companies often announce the next quarterly dividend several weeks before they come out with the previous quarter’s earnings results.

Even more fun is that a number of these companies increase their dividend rates every quarter. I really look forward to finding out the magnitude of the increases.

Until a few years ago, most energy infrastructure companies (also called energy midstream) were in the majority structured as publicly traded master limited partnerships (MLPs). At that time, the terms MLPs and energy midstream companies sort of meant the same thing.

However, since the energy sector crash that started in 2014, bottomed in 2016, and continues to hold back these companies today, many MLPs have elected to restructure into different forms, so you now have both corporations and MLPs in the group of companies I call energy infrastructure or energy midstream.

If you are unfamiliar with energy midstream, these are the companies with assets to provide transportation and storage of energy products between the producers and the end-users. Think of pipelines, processing plants (natural gas), storage facilities, and loading/unloading terminals.

The businesses operate on a fee for service basis, often with long-term, take-or-pay contracts. The fee-based nature of the midstream business allows these companies to generate predictable cash flow, and the stocks are excellent dividend payors.

So that you can see how attractive income investing in the energy infrastructure group can be, here are three stocks that should announce dividend increases over the next few weeks:

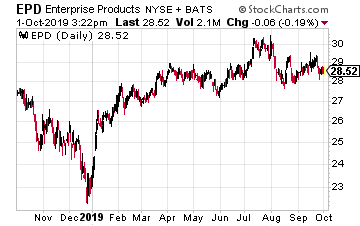

Enterprise Product Partners (EPD) is the largest publicly traded MLPs, and also the largest midstream company of any business structure type.

The company as a $63 billion market cap. EPD owns almost 50,000 miles of pipelines, natural gas processing facilities, and import/export terminals. The company also operates underground salt dome storage for several types of energy products.

The quarterly distribution (MLP speak for dividend) has increased every quarter since the 2004 third quarter. About half of free cash flow is paid out as distributions, leaving plenty of capacity for future income growth.

EPD units currently yield 6.1%.

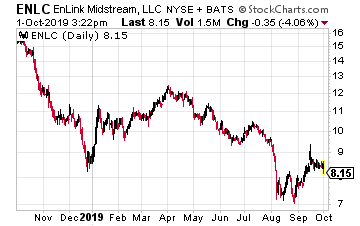

EnLink Midstream LLC (ENLC) is one of the companies that has given up on the traditional MLP structure. ENLC investors receive Forms 1099 at tax time.

The company provides a range of midstream services to crude oil and natural gas producers in Oklahoma and Texas.

EnLink operates gathering and transportation pipelines, processing plants, fractionators, barge and rail terminals, product storage facilities, brine disposal wells, and an extensive crude oil trucking fleet.

At the start of 2018, the company resumed quarterly dividend increases.

ENLC currently yields an eye-popping 13.2%.

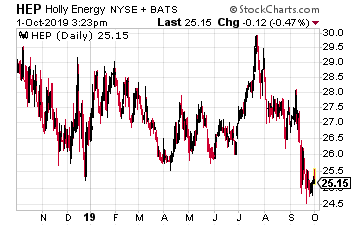

Holly Energy Partners LP (HEP) is an MLP that primarily provides midstream services to fuels refiner HollyFrontier Corporation (HFC).

HollyFrontier owns the general partner interests in HEP, which gives in primary control over the MLP. As the largest unitholder in HEP, the refiner is the primary beneficiary of the distribution growth from the MLP.

HEP has increased its distribution for 59 consecutive quarters, dating back to the companies July 2014 IPO.

Boards of directors are loath to break a track record like that.

HEP units currently yield 10.6%.

Forget the Stock Market: What You Should Be Buying Will Give You Goosebumps

If you want to retire comfortably, stop what you’re doing.

There’s a better way.

A way to stop buying stocks and bonds, are start buying the income you need to live the retirement of your dreams.

Click here to learn what I’ve uncovered.

Category: Commodity Stocks