Kinder Morgan: A Recession-Resistant High-Yielder At Low Prices

Kinder Morgan Incorporated (NYSE: KMI) has a long and controversial history among dividend investors.

They cut their dividend a few years ago, but have since recapitalized the company into a much more reliable platform for dividend growth going forward.

After the late-2018 sell-off, I’m certainly a buyer of Kinder Morgan at today’s prices. Dedicating a portion of your asset allocation to dividend stocks like KMI is a good form of diversification.

Source: Google Finance

Kinder Morgan: Old Vs New

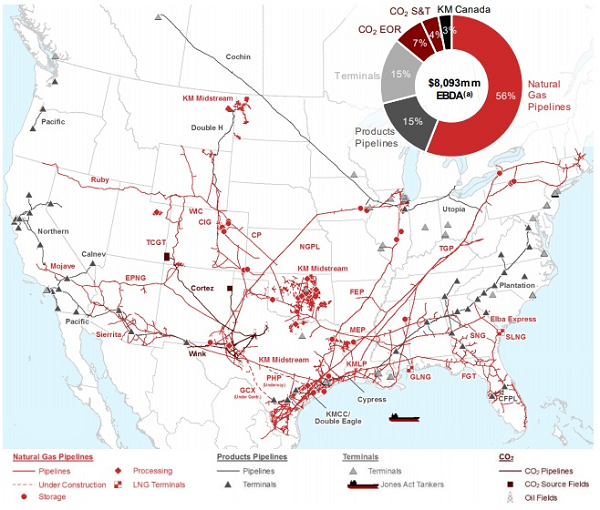

Kinder Morgan is the largest transporter of natural gas in the United States. Their map of operations spreads over the whole country:

Source: Kinder Morgan December 2018 Investor Presentation

They own or operate 70,000 miles of natural gas pipelines, 10,000 miles of petroleum products pipelines, and over 150 terminals.

The old version of the company was heavily-leveraged and reliant on continually issuing new shares to fund growth projects. But when oil prices crashed in 2015, and their share price dropped, and they couldn’t continue issuing new shares to fund growth when their share price was so low, so it was a vicious cycle and a liquidity crisis. This fragile business model was punished as the company was forced to cut its dividend and sell a lot of assets to stay solvent.

After years of recovery, the company is now positioned to continue growing a lot more safely than before.

Rather than being heavily-leveraged, the company now only has 4.5x debt to EBITDA, which is reasonable for the midstream industry. Rather than relying on issuing new shares to fund growth, the company is now self-funding, and a net buyer of its own stock. The company pays less than 50% of its distributable cash flow as dividends (currently yielding over 5%), and the rest to fund growth.

Therefore, they have the same amazing infrastructure assets that they’ve always had, but now with a sound financial structure.

In a world with high global debt, a business that pays 5% dividends and primarily focuses on transporting natural gas with a modest growth rate should hold up well in a recession.

Many midstream companies have sky-high yields of up to 10% or more, but they also have very low distribution coverage, meaning that even a small drop in cash flows would put their distribution in jeopardy. Kinder Morgan currently pays one of the lower yields in the midstream industry, but with the highest payout ratio and highest dividend growth rate.

And many midstream businesses are not self-funding. Some of the best ones, like Magellan Midstream Partners, Enterprise Products Partners, Enbridge, and Kinder Morgan have all transitioned to a self-funding business model that gives them plenty of protection from volatile capital markets. They have lower yields, but are the blue-chip stocks of the industry.

Growth Prospects and Risks

Kinder Morgan has to consistently replenish its pipelines to maintain adequate growth. Energy infrastructure is a relatively crowded industry with a lot of players, so their growth is by no means assured.

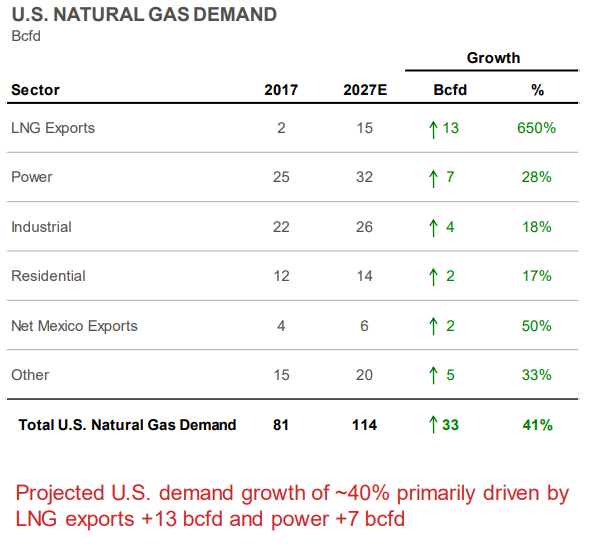

However, the total pie is growing. Natural gas demand is expected to increase over 40% from 2017 to 2027, primarily driven by LNG exports and power generation:

Source: Kinder Morgan December 2018 Investor Presentation

The subject of power is an interesting one. Natural gas is one of the main sources of emerging for powering America’s electrical grid, and it’s taking market share from coal. As electric vehicles become more prevalent, there will be less need for oil for energy transport, and more demand for electricity that will come from a variety of sources, especially renewables and natural gas.

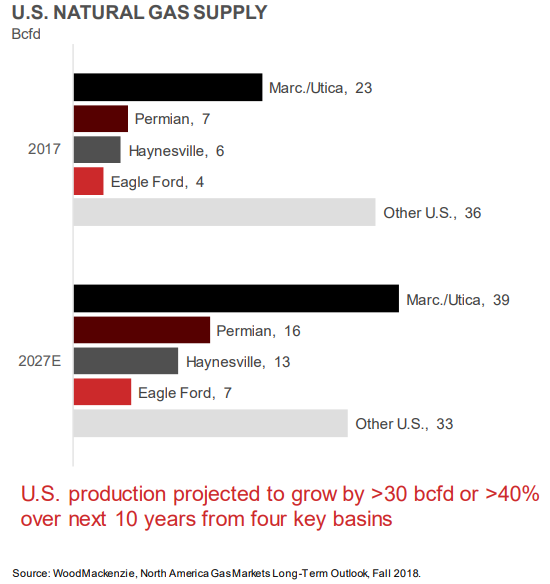

And the anticipated supply is expected to keep pace with this demand:

Source: Kinder Morgan December 2018 Investor Presentation

At these low stock prices, as long as Kinder Morgan can acquire its fair share of new infrastructure construction to transport this natural gas to where it needs to go, shareholders should do well. Right now, they have a $6.5 billion secured backlog of growth projects into 2019.

A company that pays a 5% dividend yield, raises its prices in line with inflation (let’s say 2% per year), and can grow its per-share cash flows at just 3% per year, can give investors 10% annual returns in a world of slow growth.

Option Ideas

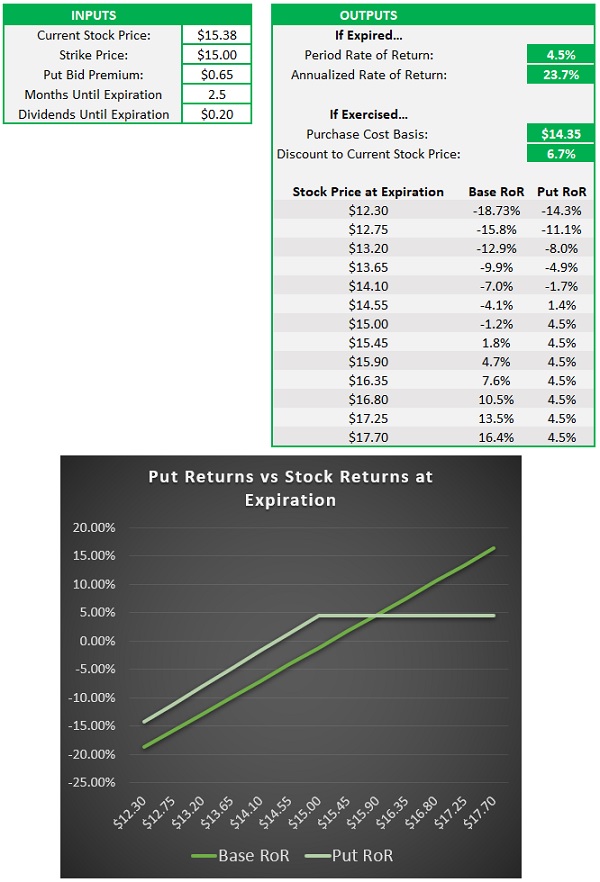

To further reduce your cost basis and protect your capital, you can also sell put options on Kinder Morgan stock.

Right now, the stock is trading a bit over $15/share. You can sell March 2019 put options for $0.65/share at a strike price of $15. This will give you 4.5% returns in two and a half months if not assigned, or result in a cost basis of $14.35 if assigned.

Source: Author’s Work in Excel

In my opinion, the best way to invest in Kinder Morgan with today’s volatile prices is to buy some shares now, and sell some put options to get paid to wait to potentially buy a second tranche if the continues to dip lower in the coming months.

Disclosure: The author of this article is Lyn Alden. She is long KMI and ENB. This article originally appeared at Modest Money on January 1, 2019.

Category: Commodity Stocks