Newmont Goldcorp: Assessing The Outlook For This Gold Stock

Gold has proven an extremely popular investment over time. Investors are drawn to its “safe haven” status, meaning it tends to outperform equities in harsher economic times, and during other times of market volatility. This can be accomplished via investing directly in gold, either physically or through an exchange-traded fund like the GLD.

It can also be accomplished by investing directly in gold stocks, which tend to see outsized moves in their earnings based upon metal prices. This can create opportunities for bold investors that are willing to stomach some volatility to grab an undervalued mining company when things aren’t going to plan.

This dynamic works both ways and in times of strong gold price performance, such as what we are seeing now, gold companies tend to overshoot to the upside as well. That’s where we find Newmont Goldcorp Corporation (NEM) as it has rallied enormously in the past three months or so, and as a result, we find it to be quite overvalued.

In this article, we’ll take a look at Newmont Goldcorp’s recent financial results, its prospects for future growth, and its total return outlook.

Recent Financial Results

Newmont Goldcorp is the product of a very recent merger between Newmont Mining and Goldcorp. The mega-merger in the mining industry created a behemoth with a $33 billion market capitalization that generates about $10 billion in annual revenue. The combined company can trace its lineage back to 1916 and has been publicly-traded since 1940. Newmont Goldcorp is now the world’s largest gold producer by reserve value, market value, and production.

Newmont Goldcorp reported second quarter earnings on July 25th, 2019, and results showed strong growth thanks to the merger. Revenue came to $2.26 billion, a 36% increase compared to last year’s Q2 when the companies were still independent. Gold product rose to 1.59 million ounces – a gain of 37% year-over-year – and all-in sustaining costs were $1,016 per ounce, which is quite high.

Goldcorp’s production costs negatively impacted Q2’s production costs, but it provided a sizable increase to the number of ounces mined as well. Newmont Goldcorp is attempting to mitigate some of this increase in costs with a cost-savings program. Even so, the company’s all-in sustaining cost number was very close to last year’s Q2.

Average realized price for gold was $1,317 in Q2, an increase of $25 per ounce over the comparable period last year. Copper prices fell substantially to $2.48 per pound, while silver average realized price was $14.20 per ounce. Given recent price action in silver and gold, we’d expect Q3’s average realized prices to be much better than they were in Q2.

Newmont Goldcorp ended the quarter with $1.8 billion in cash on hand after returning $590 million to shareholders, resulting in a leverage ratio of 1.5X net debt to pro forma adjusted EBITDA following the merger. The company noted it also paid down $1.25 billion of legacy Goldcorp debt at the time of transaction close.

In total, adjusted net income came to $0.12 per diluted share, which was less than half of what the company earned in last year’s Q2. However, because of the merger, results aren’t necessarily directly comparable. There are significant transaction and integration costs built into Q2’s number, as well as non-merger items such as fair value changes, gains on asset sales, and reclamation and remediation charges on legacy sites.

Growth Prospects

Newmont Goldcorp’s earnings-per-share have been predictably volatile over time as the company grapples with constantly-shifting production costs, as well as unpredictable metal prices. Of course, this isn’t unique to Newmont Goldcorp by any means, but it is still very much a large component of the company’s outlook.

We forecast 5% annual earnings-per-share growth following the closing of the merger, much of which depends upon metals pricing. Obviously, Newmont Goldcorp has little control over the prices it sells its metals for, but it does have control over other factors that we see driving earnings growth.

The company has significant development projects in its pipeline, which should drive better volumes over time. The volume benefit of the merger produced a huge boost in volumes in Q2, which we will certainly see in the next three quarters as well.

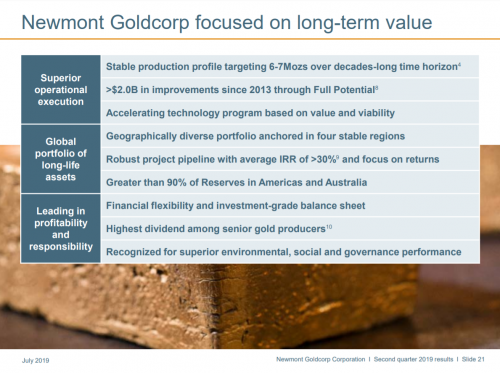

The merger is seeing the combined company struggle with costs, but over time, we expect that to mitigate somewhat. Indeed its “Full Potential” program has already achieved in excess of $2 billion in improvements since it was introduced in 2013, which is part of the company’s focus on long-term value creation.

Source: Investor presentation, page 21

That should help with growth as production costs should fall gradually over time, but the company is also targeting six to seven million ounces of production over the long term. This is counter to some other miners which try to pull as much metal from they ground as they can over a short time frame. Newmont Goldcorp is building for sustainability, and we think that is an attractive trait for a miner.

While results will certainly be lumpy over time, we see Newmont Goldcorp as having one of the more favorable outlooks among the miners. We like its focus on long-term sustainability, its focus on cost savings, and its enormous size and scale following the merger

Total Returns

Unfortunately, this is already priced into the stock. Newmont Goldcorp trades for 31 times this year’s earnings estimate of $1.30, which is 147% of our fair value estimate of 21 times earnings.

Given the 1.4% dividend yield, our estimate of 5% earnings-per-share growth, and a ~7% headwind from the valuation, Newmont Goldcorp stock is projected to deliver negative total annual returns in the coming years. The recent rally in the stock has made it untenably expensive, and we suggest that investors interested in owning the stock wait for a sizable pullback before initiating a position.

Final Thoughts

Newmont Goldcorp has a bright future in the mining industry following its mega-merger earlier this year. The company’s fundamentals are strong, but the share price has risen too high based upon the company’s earnings. The current upcycle for metal prices has sent Newmont Goldcorp’s valuation to an unsustainable level, and therefore investors should avoid the stock on valuation concerns.

Note: This article originally appeared at Modest Money. It was contributed by Sure Dividend.

Category: Commodity Stocks