Osisko Gold Royalties: Set To Prosper From Gold Appreciation

Osisko Gold Royalties (NYSE: OR) is one of the smaller gold royalty and streaming companies, and it is quite well-positioned for a bull price appreciation in gold. Importantly, it’s also reasonably well-protected from a potential bear market in gold compared to many gold miners.

Gold royalty and streaming companies don’t operate mines themselves, and instead they finance mines and expansions for gold miners. This generally makes them into very lean, profitable operations whereas other gold stocks have historically troubled to consistently generate a profit. For this reason, Osisko has a lower break-even price in gold for it to make a profit, which is ideal.

However, a unique aspect of Osisko is that in addition to their primary streaming and royalty business, they hold minority stakes in a variety of public gold mining stocks, including Osisko Mining, Osisko Metals, Barkerville Gold Mines, Falco Resources, and Victoria Gold Corp. This gives them some extra upside potential in the event that the price of gold appreciates in price.

Osisko Gold Royalties: Growth, Value, and Safety

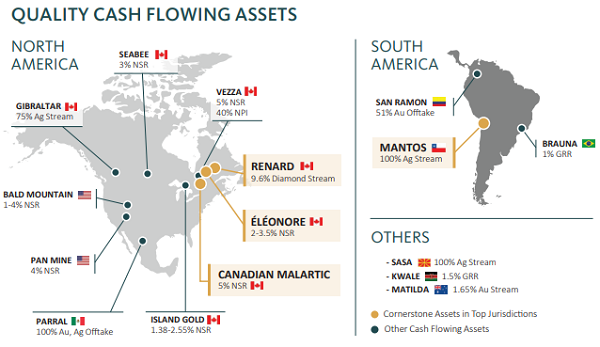

Osisko has over 130 different streaming and royalty agreements, and over 100 of them are in North America. Only 2 are in Africa. In other words, there is very little jurisdictional risk for Osisko’s investments, unlike some of their peers.

Source: Osisko January 2019 Factsheet

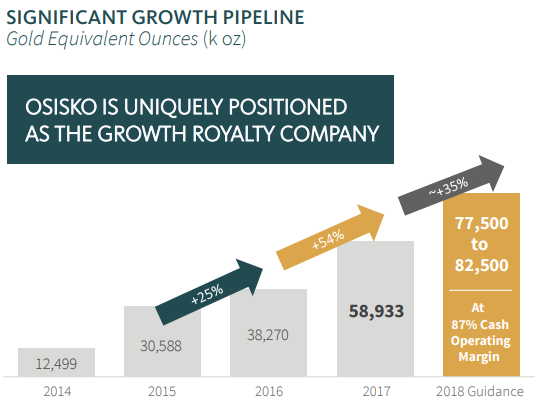

In addition, Osisko has been growing rapidly as more of its investments start producing gold:

Source: Osisko January 2019 Factsheet

Because the major gold royalty and streaming companies have been so successful, many of them are highly-valued. The biggest ones are the most highly-valued.

Being smaller and more volatile, Osisko trades at a much lower valuation than its big peers like Franco Nevada. Osisko has recently decided to take advantage of this by authorizing a $100 million CAD share repurchase, which should increase the value of each remaining share. This should be a good investment because Osisko shares are currently trading for a price approximately equal to their tangible book value.

The company does have some debt, but their cash and investments in miners are available to pay it off if needed. Overall, the balance sheet is moderately strong, and represents a mildly leveraged play on gold appreciation and stream/royalty growth.

The Case for Gold Appreciation

Gold is a difficult commodity to determine a value for, but there are two key charts worth highlighting.

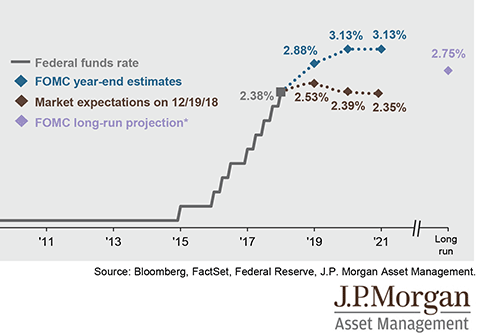

Chart 1) Interest Rate Expectations

As this article describes, gold often bottoms (and thus starts a nice bull run) when interest rates set by the Federal Reserve hit a peak.

Right now, the market expects that we’ve basically just hit peak interest rates for this market cycle.

Source: JP Morgan Guide to the Markets, 1Q2019

The reason interest rates affect gold has to do with opportunity cost. If banks pay you a high inflation-adjusted interest rate to hold your money in the bank, it makes sense to sell gold and hold cash for the interest. However, when banks pay low or negative inflation-adjusted interest rates, many investors believe it makes sense to store their wealth in gold instead.

Cash in a bank is actually the bank’s liability. Although it’s backed up by federal insurance, cash is tied to the bank’s 10-to-1 leverage ratio and vulnerable to money-printing and devaluation. There’s less of an incentive to hold it over gold when it doesn’t pay you anything.

Therefore, when Federal Reserve interest rates hit a peak and eventually go down, that’s often bullish for gold.

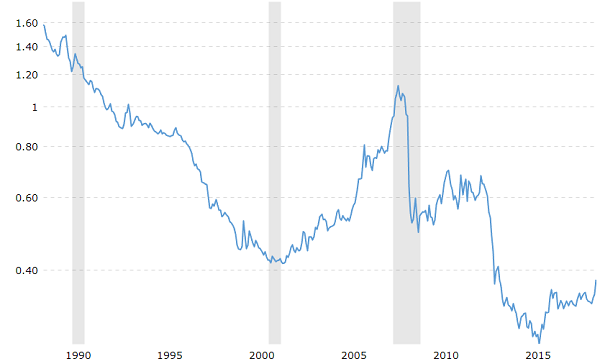

Chart 2) Gold Price to Monetary Base

Central banks keep printing more money, and that monetary base grows a lot faster than gold.

This chart shows the ratio of the price of gold to the adjusted monetary base of the United States:

Chart Source: Macrotrends

During 2001, which preceded a massive decade-long bull market in gold, the ratio was 0.41. It then spiked to a peak of over 1. After that, trillions of dollars of quantitative easing by the Federal Reserve drastically increased the monetary base, and the ratio to gold hit an all-time low of 0.26 in late 2015.

The ratio has since increased to 0.38, which is still historically low, including below where the ratio was prior to the most recent huge bull market. Decades ago, the ratio has been over 4.

Overall, this chart suggest considerable upside potential for the price of gold because the monetary base has expanded so fast and the price of gold hasn’t caught up with it yet. It would likely take a time of economic fear and uncertainty, like a severe recession, to restore the ratio to a higher and more normal level.

Final Thoughts

I think holding precious metals and precious metals stocks for at least 5% of a portfolio is prudent for risk management. It may act as a hedge against the next big market decline or recession.

For example, during this recent bear market in U.S. equities, my 5-7% gold and gold stock allocation appreciated by about 10%, which allowed my portfolio value to hold up a lot better than the S&P 500 and other big stock indices.

It’s not guaranteed to work like that every time, but gold can serve as a form of diversification away from stocks, bonds, and real estate which are collectively at record valuations.

Disclosure: The author is long gold, OR, and FNV.

Note: This article originally appeared at Modest Money. The author of this article is Lyn Alden. Lyn is an engineer and investor with a graduate degree in engineering management, and much of her career has been in technical procurement, project management, and budget planning. She has over a decade of investment experience with a focus on income-producing assets, and writes in-depth articles about finance at LynAlden.com.

Category: Commodity Stocks