Gold Miners Could Be Ready To Run

One of the unsung stories of the last few months is the resurgence in gold prices. An ounce of gold has climbed from a low of about $1,200 in mid-November to over $1,300 as of this writing. That’s a pretty sizable jump in a relatively short amount of time.

There are a few reasons why gold may be on the move higher. At least part of it could be due to the amount of overall uncertainty we’ve seen this year – with plenty of unresolved issues remaining at the macro level. But perhaps more importantly, the Fed’s commitment to keeping interest rates low could lead investors to believe that inflation is going to surface anytime now.

Since gold is considered a decent hedge against inflation, it may be a big part of why the rally has occurred. (Gold is actually a better hedge against deflation than inflation, but generally speaking, uncertainty over future currency levels leads to more demand for gold).

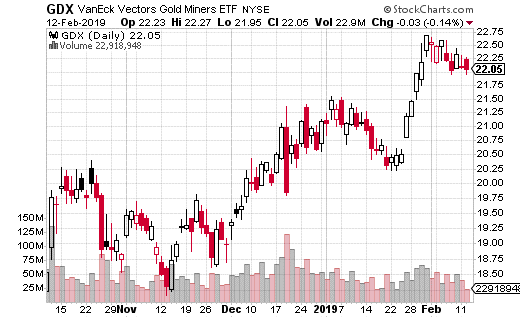

Along with gold itself, gold miners have also benefited from the renewed interest in precious metals.

VanEck Vectors Gold Miners ETF (NYSE: GDX) is a widely popular method for investing in gold miners. The ETF invests in the biggest gold miners that trade in the US and Canada. About 60% of the fund’s holdings are invested in the top 10 names in the industry.

GDX trades nearly 50 million shares a day on average – making it one of the most heavily traded ETFs. It also averages about 85,000 option contracts per day. Very few other ETFs or stocks can beat that average.

Gold miners have the advantage of tracking gold but also producing an income stream. That makes them a bit more palatable to many investors in comparison to the commodity itself. Not to mention, GDX even offers a dividend, something gold bullion can’t ever do.

A fund or well-capitalized trader just rolled out 10,000 GDX calls to May, suggesting gold miners could be in for a big rally over the next 3 months. The trade itself was the purchase of the GDX May 17th 22 calls for $1.22 with the stock trading at $22.15 per share.

At 10,000 contracts, it means the trader spent $1.2 million in premium, which is obviously a strong commitment to GDX’s upside. That’s because the premium is the max loss potential on the trade, so if GDX is under $22 at May expiration, the calls will be worth zero.

That sort of confidence in GDX’s upside also suggests that gold and gold miners are going to maintain the gains they’ve seen over the last month or so. Of course, the call buyer is looking for more than just sideways movement. For every dollar above the breakeven point of $23.22, the trade pulls in $1.2 million in profits.

If you’re bullish on gold miners, you could make this same trade. Or, if you want to save some money and do a similar trade, you could turn the trade into a call spread instead. With GDX trading at around $22, the 22-24 May call spread is trading for about $0.70.

That lowers the breakeven point to $22.70 and your max loss is down to $0.70 per spread. You max gain is capped at $24 or above in the stock, which is $1.30 after accounting for the cost of the spread. Still, that’s 186% potential gains for a relatively inexpensive trade that covers the next three months.

[TRENDING NOW]: This 36-Month Accelerated Income Plan Pays Your Bills For Life

One simple plan takes minutes to set up, yet could pay all your bills for life. No longer will your mailbox be stuffed with ‘payment due’ envelopes.

This is our most powerful plan we’ve ever put together…and nearly 7,000 retirement investors have already used its recommendations.

There is still time to start generating $4,084 per month for life…but the window is closing. Click here for complete details.

Category: Commodity Options Trading