How Much Could You Make When Your Dividend Stock Pays An 18% Yield?

I feel like we have moved into a Dr. Strangelove type of financial world. The economic data shows that the U.S. economy is doing fine. We have growth in the economy, low unemployment, and rising wages.

Home prices continue to increase. In contrast, on the financial markets side of the universe, traders are pushing bond prices, making yields and stock prices act like the next Great Recession starts on Friday.

One effect of this schizoid financial world is the new existence of dividend stocks, with solid cash flow coverage and actual dividend growth trading with yields of 12%, 15%, even 18%.

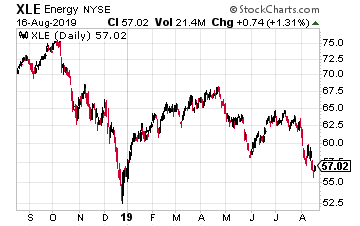

Energy is one economic and stock market sector that has been hit hard by the fears of an economic slowdown or possible recession. The Energy Select Sector SPDR (XLE) is down 18% from its 2019 high.

The sector is trading like the world is going to stop driving vehicles, turning on the lights, or running their air conditioners. Fundamental analysis and logic have no place in the current fear-driven energy stocks investor strategy.

One of the effects of this sell-off is that you now have energy midstream companies trading to pay tremendous dividend yields. The midstream sector provides the transport, storage, and other services to get oil and natural gas from the production plays to the refineries and power companies that consume the energy commodities.

Midstream companies deliver their services on long-term fixed-fee contracts. Interstate pipelines have rates set by the Federal Energy Regulatory Commission, with built-in annual rate increases.

Shippers on pipelines and users of energy storage commit to minimum volumes, so the midstream revenues are very predictable and growing. With stable, predictable cash flows, most energy midstream companies pay out most of their free cash flow as dividends. This is a business sector where income-focused investors can earn attractive returns.

The 2019 energy sector crash has not exempted these solid dividend-paying companies. Many have fallen harder and farther than the stocks of energy companies whose profits are dependent on the prices of energy commodities. Go figure.

As a result, there are midstream companies with solid revenue and cash flow stream, long term records of growth and even growing dividends that currently sport yields from the low teens up into the high teens. Maybe the market is right, and the next recession starts tomorrow. Or perhaps it’s wrong, and this is a once in a decade opportunity for income-focused investors.

Here are three midstream stocks with very high yields. Do your research and decide if these companies will be able to continue to pay dividends. I did mine and I think, yes.

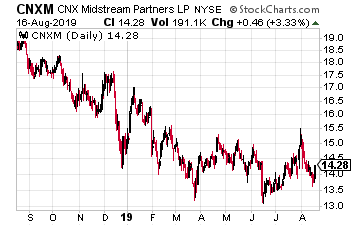

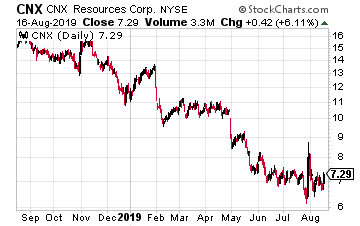

CNX Midstream Partners LP (CNXM) is a master limited partnership (MLP) that owns, operates, develops and acquires gathering and other midstream energy assets to service natural gas production in the Appalachian Basin in Pennsylvania and West Virginia. The midstream company is sponsored and controlled by upstream energy producer CNX Resources Corp (CNX).

At least a portion of CNXM revenues are dependent on production growth by CNX. In its second-quarter earnings notes, CNX increased their 2019 production guidance, with 12% annual growth predicted. CNXM has been growing distributions paid to investors by 15% per year.

Distributable cash flow (DCF) coverage is a strong 1.6 times the distribution. This MLP will increase its payout every quarter and currently yields 11%.

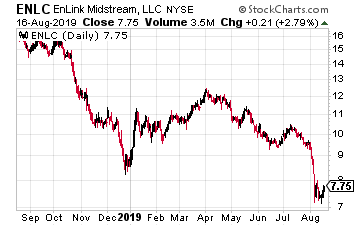

EnLink Midstream LLC (ENLC) provides midstream services for natural gas, crude oil, condensate, and NGL commodities. The company has its assets in premier production basins and core demand centers, including the Permian Basin, Oklahoma, North Texas, Ohio River Valley, and the Gulf Coast.

EnLink Midstream was created by Devon Energy Corp. (DVN).

A year ago, Devon sold its interest in ENLC to privately held Global Infrastructure Partners (GIP). This has produced investor uncertainty about the future of EnLink.

Company management has given guidance of 6% annual dividend growth with 1.3 times DCF coverage. That is very solid in the midstream world.

ENLC shares yield 15%.

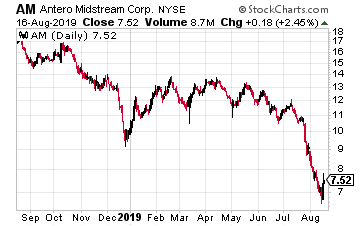

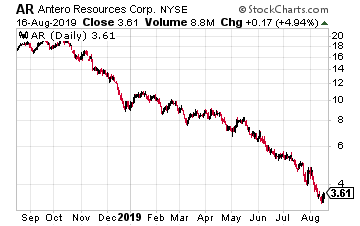

Antero Midstream Corp. (AM) is another midstream services provider focused on natural gas gathering and other midstream services in the Appalachian Basin. AM primarily provides its services to upstream producer Antero Resources (AR).

Early in the year, the current version of Antero Midstream was formed with the merger of an MLP and its publicly traded general partner. A good move for investors.

Recently Antero Resources had a Board of Directors take over by the former heads of Rice Energy, which was acquired by Antero in 2017.

Despite solid growth plans for this year and future years from both companies, the corporate turmoil has investors dumping shares driving down prices.

AM has been growing its dividend every quarter yet is priced to yield an astounding 18%.

“My Wife and I Are Living Off the Endless Income Payments”

You are missing out…

You could be making monthly dividend payments of $4,587, $3,470, and $5,012 or more deposited into your account like clockwork.

If you have doubts, I don’t blame you.

People tell me all the time that this strategy will not work for them…

Heck, that’s what Tom and Gayle H. said when they first started following my recommendations.

But now, two years later, they’re true believers:

“I have had great success investing my retirement nest egg using your Endless Income Blueprint. [Since joining] my wife and I are living off of the payments… thank you from two very grateful subscribers.”

You can be just like them.

All you need is a Blueprint.

All the best tips, tricks, and strategies for earning endless income payments.

Category: Commodity Stocks